Insuring Treasured Gems Finding the Right Jewelry Insurance

Insuring Treasured Gems Finding the Right Jewelry Insurance

When my grandmother passed away, she left me a beautiful sapphire ring that had been in our family for generations. It's not just a piece of jewelry; it's a tangible memory, connecting me to tales of old family gatherings and the vibrant personality of a woman I deeply admired. Protecting this piece of history became as paramount as preserving any photo album. That’s when I started learning about jewelry insurance.

Jewelry is more than an accessory—it's a statement, a memory, or an investment. Yet, despite its emotional and financial value, many of us overlook insuring these precious items. It might seem like a dry topic, but understanding jewelry insurance can be as comforting as wrapping yourself in a favorite family story.

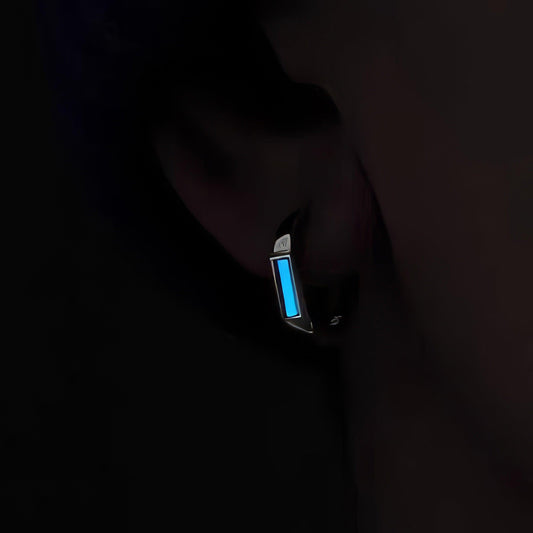

First, let's talk coverage types. Many standard homeowner's insurance policies offer limited protection for jewelry, often capping at around $1,500 for losses. If your diamond earrings or heirloom necklace exceed that value, a standalone jewelry insurance policy is a wise consideration. This type of insurance typically covers mysterious disappearances, theft, and damage—including incidents that might occur outside the home. Imagine losing a brooch at an extravagant wedding across the coast without this kind of coverage. It's not a scenario many wish to ponder.

There’s also an emotional angle to consider. Have you ever misplaced something and felt your heart race, even for a moment? Knowing you have comprehensive insurance can provide peace of mind, softening the blow if something unfortunate does happen. It's a bit like carrying an umbrella on a cloudy day—often, it’s the psychological comfort that makes the difference.

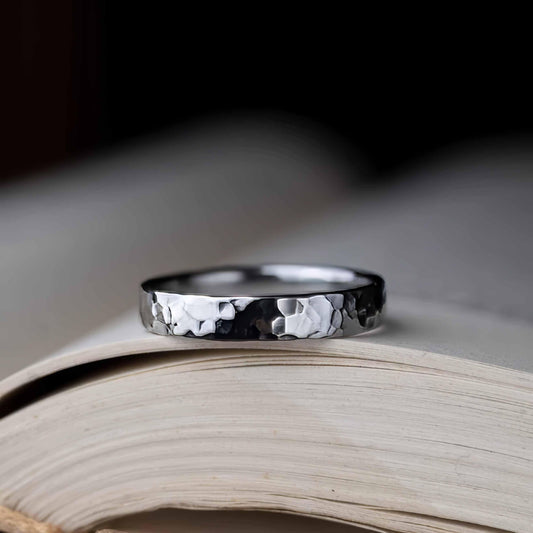

When evaluating the best jewelry insurance plan, consider the appraisal process. Insurance providers typically require a professional appraisal, ensuring that your items are valued accurately. This step is crucial because it influences your premium and the payout you’d receive if your jewelry were lost or damaged. This process is sometimes overlooked, but I've found it an enlightening experience—uncovering the stories behind the gems and gaining a deeper appreciation for their craftsmanship.

While sifting through information, don't hesitate to explore customer reviews and expert opinions. These perspectives can reveal insights that formal descriptions might miss. For instance, some companies might have excellent reputations for handling claims swiftly and empathetically—qualities that matter when you're stressed about a lost piece.

Incorporating jewelry insurance into your life is like adding another layer of security to your cherished possessions. Since acquiring a policy, wearing my grandmother’s ring has felt significantly less fraught with worry. It's a small adjustment in the grand scheme of insurance, but it has provided immense peace of mind. After all, certain items are priceless not because of their market value, but because they carry the weight of stories untold.