Understanding the Cost of Jewelry Insurance

Understanding the Cost of Jewelry Insurance

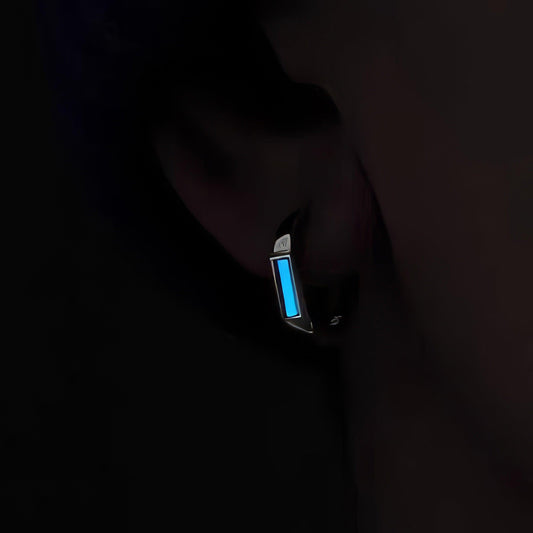

Years ago, when my grandmother passed away, she left me a beautiful sapphire ring. With its deep blue hue and intricate vintage setting, it was not just a piece of jewelry—it was a legacy, a family heirloom with countless stories embedded within its very metal. Keeping it safe was paramount, a sentiment I'm sure many share when it comes to their treasured pieces. This leads us to an often-overlooked necessity: jewelry insurance.

The cost of jewelry insurance can be as varied as the pieces it protects. On average, insuring your jewelry can cost between 1% to 2% of its appraised value annually. So, if you have a piece valued at $5,000, you might expect to pay around $50 to $100 per year for coverage. However, this is just a broad estimate and several factors can influence the premium you might pay.

First, consider where you live. Insurance rates can fluctuate based on your location due to different risks associated with theft or natural disasters. Living in a bustling urban area might lead to a higher premium compared to residing in a quiet, less populated town. It's fascinating how geography can influence something as personal as jewelry insurance, isn't it?

The type of coverage also plays a crucial role. Some policies cover accidental loss, mysterious disappearance, or theft, while others might offer protection against damage. Imagine accidentally dropping that precious heirloom ring down the sink or inadvertently scratching its surface. Comprehensive coverage might seem like an unnecessary expense until, one day, it’s not.

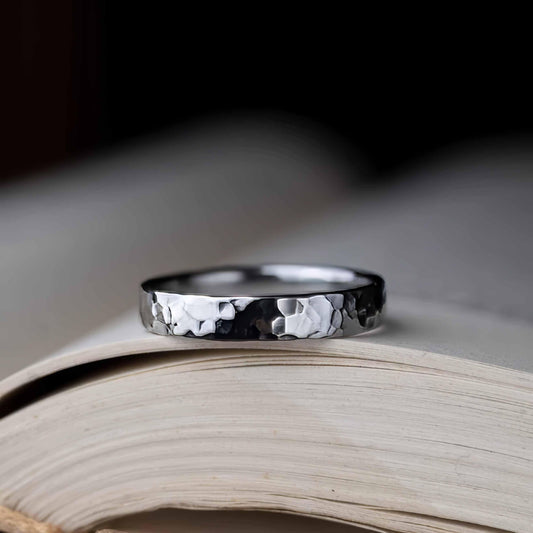

Then, there's the matter of the jewelry itself. Insurance companies typically require an appraisal to determine the value of a piece. Precious stones like diamonds, emeralds, or sapphires can elevate a piece's value, thus increasing the insurance cost. Reflect on the time when my aunt misplaced her diamond bracelet at a family reunion; having it insured provided her not just financial protection, but peace of mind—priceless in its own right.

Policies often require periodic appraisals to adjust coverage in line with current market values. Consider the ever-changing market for precious metals and stones; what was worth $2,000 five years ago might be worth significantly more today, or sometimes less, depending on economic fluctuations and trends.

So, what’s the takeaway here? Jewelry insurance isn’t just about safeguarding a monetary investment, it’s about protecting memories and pieces of personal history. Like my grandmother’s sapphire ring, which whispers tales from a past generation, some pieces carry far more value than what any appraisal might conclude.

Navigating the world of jewelry insurance brings with it a web of considerations, each more intricate than the last. But regardless of the complexities, one thing remains clear: ensuring the safety of our cherished pieces is a small price to pay for the peace of mind and the comfort of knowing that our stories—told through the medium of these gems—remain safe.