Understanding the Cost of Ring Insurance Is It Worth It

Understanding the Cost of Ring Insurance Is It Worth It

I never thought much about ring insurance until a rather embarrassing incident at a friend's wedding. As the best man, I was tasked with safeguarding the rings—small, shiny symbols of commitment and love. As I fumbled around in my pocket for what felt like an eternity, my heart stopped when I realized only one ring was there. After an agonizing minute that felt like a lifetime, I found the second ring safely nestled in a tiny fold of the pocket. Crisis averted, but the experience got me thinking: what if the ring had genuinely been lost?

Jewelry insurance might not be something that comes up often in casual conversations, yet it represents an essential financial consideration, especially for items as significant as engagement or wedding rings. But how much does it really cost to insure something so small yet so profoundly valuable?

The cost of ring insurance can vary widely, typically ranging from 1% to 3% of the ring's value per year. For instance, if your ring is valued at $5,000, you might end up paying between $50 to $150 annually. It might not seem like a hefty amount initially, but over a lifetime, those costs do add up. Still, there is an undeniable peace of mind in knowing that these cherished items are protected against loss, theft, or damage.

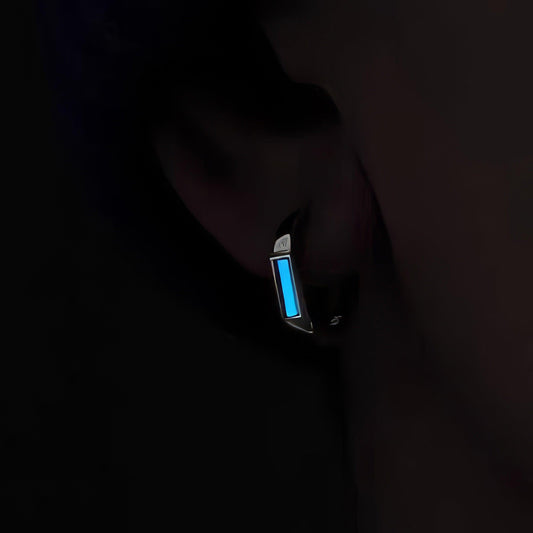

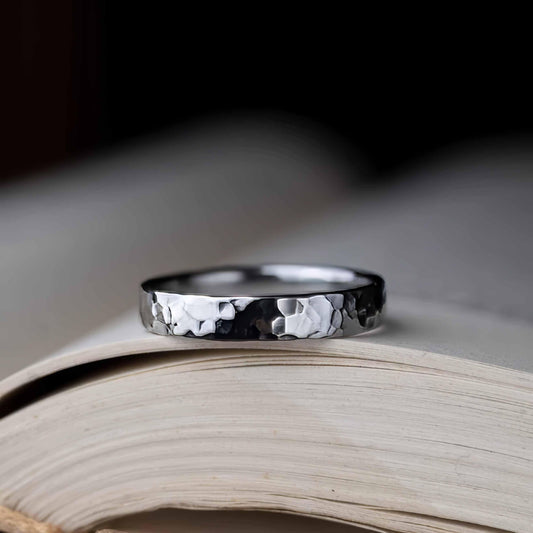

Several factors influence this cost. The value of the ring is the most obvious one, but the geographic location can also play a role. Living in an area with a higher crime rate might bump up your premium. Similarly, storing the ring in a home security system might lower it. Then, there are the materials. Some materials, like platinum, are more expensive to repair, which can also drive the insurance cost up.

Yet, beyond the practicalities and numbers, there's an emotional side to consider. Rings are steeped in personal and cultural significance. In many Western cultures, engagement rings symbolize promises and shared futures—stories told in glimmering diamonds or vibrant rubies. They're reminders of a defining moment and the person who made it possible. My grandmother’s modest but endearing emerald ring, for instance, tells tales of a simpler time when love letters were penned by hand and Sunday dances were the highlight of the week.

Even so, not everyone opts for expensive insurance policies. I once met a couple who cleverly adjusted their wedding budget to accommodate a cheaper ring, with the idea that their love didn't need an opulent symbol to validate it. For them, basic coverage sufficed, ensuring the ring was protected without incurring high expenses.

Ultimately, deciding whether to insure your ring and how much to invest in that insurance is a decision that reflects personal values as much as financial prudence. While I may still shudder at the memory of almost losing a friend's ring, I am grateful for the reminder of how these small treasures are much more than monetary investments. They're pieces of the heart worn on our fingers, where they will hopefully stay safe and sound.